Buying a house is a significant milestone for many individuals in the UK. It is certainly not an easy one. As many of life's costs are so expensive, that may leave you wondering, how are people affording houses?

In this insight, we will explain how people manage to afford houses, including those with low salaries and those aspiring to purchase million-pound properties.

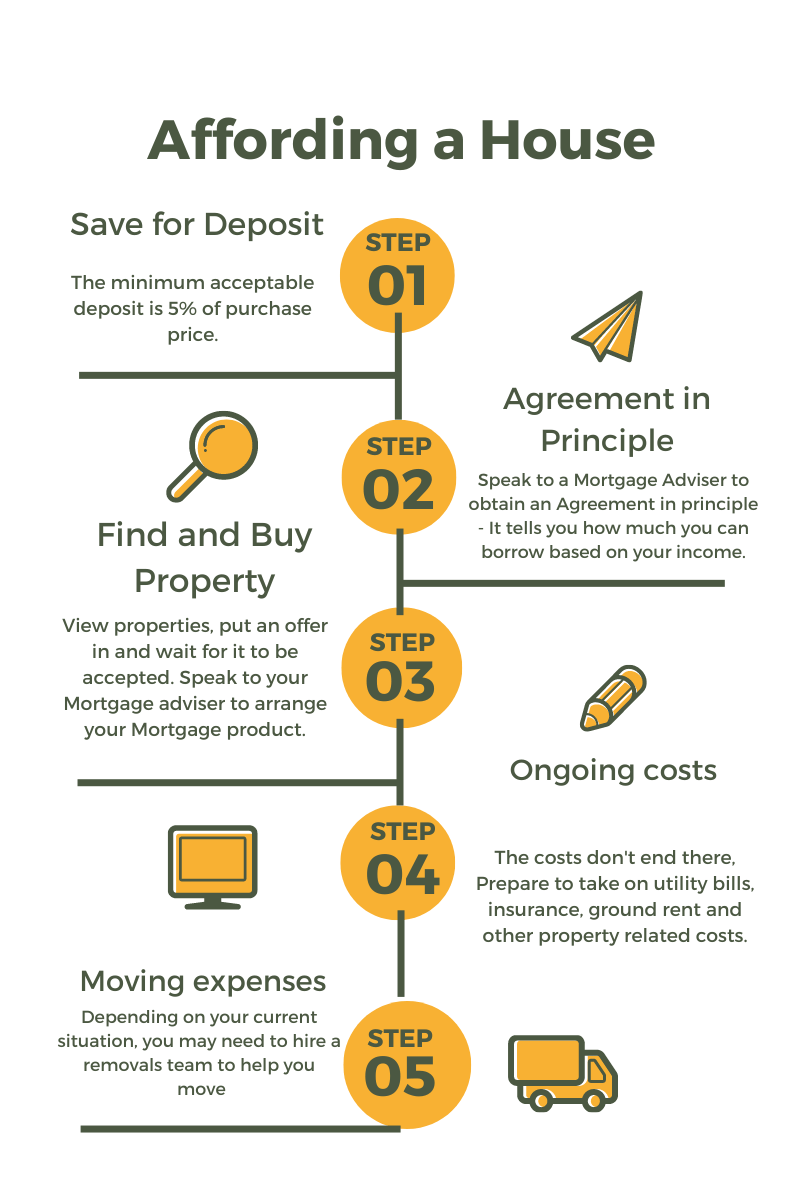

When purchasing a house, the most common strategy is to get a mortgage to help you buy. A mortgage is a loan from the bank that goes towards the purchase of a house. To qualify for a mortgage, you will normally need a deposit. A deposit is an upfront contribution to the price of the house and usually starts at 10% deposit. That leaves a mortgage required to cover the remaining 90%. The amount you can borrow on a mortgage depends on your salary. For example, a £32,000 annual salary would allow borrowers to potentially secure a mortgage of up to £160,000 (five times the salary).

Let's consider the numbers. If you earn £32,000 per year and want to buy your first home. With a 10% deposit, you would need to save £16,000 (10% of the property's purchase price) before making an offer on a house. Assuming you finds a suitable property priced at £160,000, you can provide a deposit of £16,000 and apply for a mortgage to cover the remaining £144,000.

It's important to note that mortgage lenders assess borrowers based on their income, credit history, and affordability. They consider factors such as monthly expenses, existing debt, and credit score to determine the maximum mortgage amount they are willing to lend. Meeting their affordability criteria and demonstrating responsible financial management increases the likelihood of securing a mortgage.

While a 10% deposit allows individuals to enter the property market with a more manageable upfront cost, it's crucial to consider additional expenses associated with buying a house. These expenses include legal fees, surveys, valuation costs, and potentially stamp duty, depending on the property price. Allocating funds for these expenses is essential to ensure a smooth home buying process.

Once the purchase is complete, it's important to factor in ongoing home ownership costs. These include mortgage repayments, utility bills, insurance, maintenance, and council tax. Budgeting and managing these expenses effectively will ensure that home ownership remains affordable within the £32,000 salary range.

A 10% deposit allows individuals with a £32,000 annual salary to purchase a house by securing a mortgage of up to £144,000 (in addition to the 10% deposit). However, it's essential to save for the deposit and consider other associated costs to make the home buying process more feasible.

Seeking advice from mortgage advisers can provide tailored guidance and support, helping individuals navigate the process of affording a house with a 10% deposit on a lower salary.

A 100% mortgage allows individuals to borrow the full purchase price of a property without providing a deposit. In other words, borrowers can secure a mortgage that covers the entire cost of the house they wish to purchase. This type of mortgage can be particularly beneficial for individuals who may not have substantial savings for a deposit but have a steady income.

Using the example of Sarah, who earns £32,000 per year, let's see how a 100% mortgage can help her achieve her home ownership goals. If Sarah finds a property priced at £160,000, she can potentially secure a mortgage for the full amount, without needing to provide a deposit upfront. This means that Sarah can enter the property market without having to save a significant sum of money for a deposit. However, she will now have a larger loan and that means larger repayments. Here is how repayments compare:

| Loan Amount | Repayments over 30 years @ 5% |

| £144,000 (10% Deposit) | £726.75 |

| £160,000 (100% Mortgage) | £807.50 |

It's worth noting that lenders offering 100% mortgages still assess borrowers based on their income, credit history, and affordability. They consider factors such as monthly expenses, existing debt, and credit score to determine the maximum mortgage amount they are willing to lend. Meeting their affordability criteria and demonstrating responsible financial management are important in obtaining a 100% mortgage.

100% mortgages are coming back to the mortgage market in 2023. To qualify for a 100% mortgage, you will need to have a demonstrated history of 12M+ of making rental payments and your total mortgage repayments cannot exceed the amount you were paying on your rent.

When you're on a low salary, saving becomes paramount. Start by creating a realistic budget that outlines your income and expenses. Identify areas where you can cut back, such as reducing discretionary spending, eating out less frequently, and negotiating lower bills. Every pound saved counts towards your future home. Use the Sunny Avenue budget tool to help you get started.

The UK government offers various schemes to support aspiring homeowners. The Help to Buy scheme provides equity loans and shared ownership options, enabling individuals to purchase a property with a smaller deposit. Scotland's LIFT scheme offers similar solutions to getting onto the ladder. Research available government schemes and determine if you are eligible to take advantage of them.

Shared ownership is another viable option for those on a low salary. With this scheme, you purchase a share of a property (usually between 25% to 75%) and pay rent on the remaining share. Over time, you can gradually increase your ownership share through a process called "staircasing." Shared ownership allows you to get a foot on the property ladder with a lower initial investment.

Affording a million-pound property often involves having a substantial income. High-earning professionals such as doctors, lawyers, and business executives may have the financial means to purchase such properties outright or secure substantial mortgages. Their high income and stable career prospects enable them to qualify for larger loans.

Some individuals generate wealth through property investments. They may start with a more affordable property, build equity, and then leverage that equity to purchase more expensive properties. This strategy allows them to accumulate assets and generate rental income, which can contribute to affording million-pound houses.

Receiving a significant inheritance or windfall can make affording a million-pound property more feasible. Sudden wealth injections provide individuals with the capital needed to cover the high costs associated with such properties. However, it's crucial to approach windfalls responsibly and consider long-term financial planning.

Affording a house is a challenge that requires careful financial planning and consideration of various strategies. Whether you're on a low salary or aiming for a million-pound property, saving, budgeting, exploring government schemes, and considering shared ownership can help individuals with modest incomes take steps towards home ownership. For those pursuing more expensive properties, high-income professions, property investments, and unexpected windfalls can make affording a million-pound house within reach. Remember, building a solid financial foundation and seeking professional advice can assist you in achieving your housing goals.

When it comes to determining how much you can borrow to afford a house, it depends on various factors, including your income, expenses, credit history, and the mortgage terms offered by lenders. To get a more accurate estimate, it's recommended to use a mortgage calculator like the Sunny Avenue Mortgage calculator.

This online tool takes into account your specific financial information and provides a tailored calculation based on prevailing interest rates and lending criteria.

Using the Sunny Avenue Mortgage calculator, you can input details such as your annual salary, any existing debts or financial commitments, desired loan term, and interest rate to determine the maximum mortgage amount you may be eligible for. This will give you a clearer picture of the price range within which you can comfortably afford a house.

Remember that the calculator's results are an estimate and should not be considered as a final mortgage offer. Mortgage lenders will conduct their own assessment based on their specific criteria and policies. It's always advisable to consult with a mortgage advisor or broker who can guide you through the mortgage application process and provide personalised advice based on your individual circumstances.

So, how are people affording houses? Now you know, they borrow money from the bank after saving for a deposit. To get started with buying a property, you may want to apply for a mortgage promise. A mortgage promise confirms whether you are eligible for a mortgage and how much you could potentially borrow. Complete the Sunny Fact Find for mortgage advice to get started with a mortgage promise. We will find the best-suited adviser for your needs. The adviser then contacts you to discuss how they can help. You decide how to proceed.

Stuart is an expert in Property, Money, Banking & Finance, having worked in retail and investment banking for 10+ years before founding Sunny Avenue. Stuart has spent his career studying finance. He holds qualifications in financial studies, mortgage advice & practice, banking operations, dealing & financial markets, derivatives, securities & investments.

No minimum

No minimum  Newcastle-under-Lyme, Staffordshire

Newcastle-under-Lyme, Staffordshire Free Consultations

Free Consultations

No minimum

No minimum  Free Consultations

Free Consultations

No minimum

No minimum  No obligation consultation

No obligation consultation

No minimum

No minimum  No obligation consultation

No obligation consultation

No minimum

No minimum  Free Consultations

Free Consultations

No minimum

No minimum  No obligation consultation

No obligation consultation

No minimum

No minimum  No obligation consultation

No obligation consultation

No minimum

No minimum  Free Consultations

Free Consultations

No minimum

No minimum  Coatbridge, Lanarkshire

Coatbridge, Lanarkshire Initial or Ongoing Consultation Fees

Initial or Ongoing Consultation Fees

No minimum

No minimum  Initial or Ongoing Consultation Fees

Initial or Ongoing Consultation Fees

£21,000 +

£21,000 +  Initial fee free consultation

Initial fee free consultation

London, Greater London

London, Greater London No obligation consultation

No obligation consultation

No minimum

No minimum  No obligation consultation

No obligation consultation

No minimum

No minimum  Initial fee free consultation

Initial fee free consultation

No minimum

No minimum  No obligation consultation

No obligation consultation

No minimum

No minimum  No obligation consultation

No obligation consultation

No minimum

No minimum  Initial fee free consultation

Initial fee free consultation

No minimum

No minimum  Initial or Ongoing Consultation Fees

Initial or Ongoing Consultation Fees

£51,000+

£51,000+  Free Consultations

Free Consultations

No minimum

No minimum  No obligation consultation

No obligation consultation

No minimum

No minimum  Initial fee free consultation

Initial fee free consultation

£101,000+

£101,000+  Bishop's Stortford, Hertfordshire

Bishop's Stortford, Hertfordshire No obligation consultation

No obligation consultation

No minimum

No minimum  Derry / Londonderry, County Derry / Londonderry

Derry / Londonderry, County Derry / Londonderry Free Consultations

Free Consultations

No minimum

No minimum  Stockton-on-Tees, County Durham

Stockton-on-Tees, County Durham Free Consultations

Free Consultations

No minimum

No minimum  Initial fee free consultation

Initial fee free consultation

Our website offers information about financial products such as investing, savings, equity release, mortgages, and insurance. None of the information on Sunny Avenue constitutes personal advice. Sunny Avenue does not offer any of these services directly and we only act as a directory service to connect you to the experts. If you require further information to proceed you will need to request advice, for example from the financial advisers listed. If you decide to invest, read the important investment notes provided first, decide how to proceed on your own basis, and remember that investments can go up and down in value, so you could get back less than you put in.

Think carefully before securing debts against your home. A mortgage is a loan secured on your home, which you could lose if you do not keep up your mortgage payments. Check that any mortgage will meet your needs if you want to move or sell your home or you want your family to inherit it. If you are in any doubt, seek independent advice.